Header Bidding: is it worth it yet?

Header Bidding: is it worth it yet?

An update on mobile Header Bidding

Last November we published our take on mobile header bidding — hard to believe it’s been almost 18 months—but back by popular demand we’ve put together an update on the market to help you decide if Header Bidding / Advanced Bidding / Unified Auctions / Super Auctions are for you.

Note: In this update we won’t talk definitions, technology how-to, or how it works. If you’re interested in the background our original article is still relevant. Originally we focused on Amazon’s Transparent Ad Marketplace (TAM) as they were the most prevalent player in the industry. Since then other players have emerged but we still see Amazon as the main player in the industry.

Starting with last year’s conclusions:

Our summary of 2017 pro vs. cons of Amazon Header Bidding.

The Good: 2019 CPMs look even better.

CPMs averages have actually grown. Most partners see ~5X the indexed industry average but more importantly is the volume: the average Header Bidding client earns 31% of their US banner revenue from Amazon.

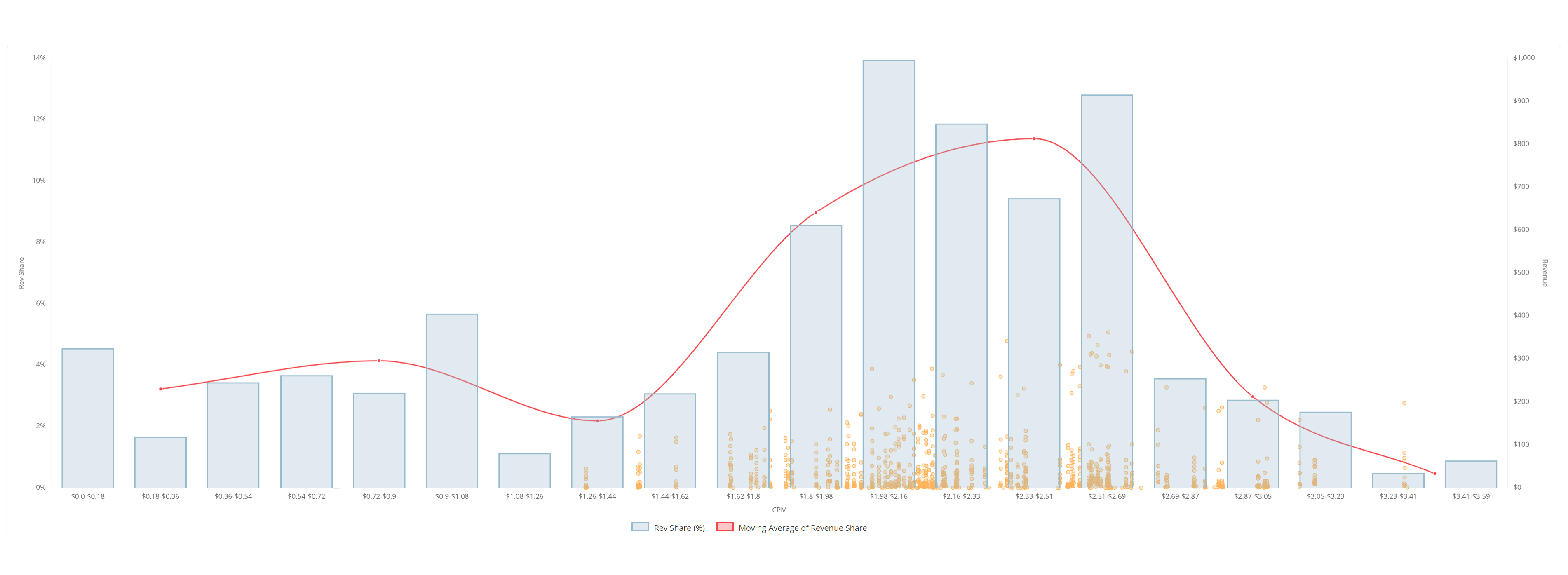

As you can see from a typical revenue distribution of United States inventory featuring Amazon Header Bidding, they largely find & purchase higher-value inventory.

Note: this chart is only showing scatter points of Amazon HB buys, other buyers are included in the revenue-share histogram but not shown in the scatter-plot.

The Bad: Serving discrepancies are better – but still causing issues.

For the most part, serving discrepancies have been reigned in, only coming in at about double the industry average. However we have plenty of our clients have reached an impasse with the implementation and have shelved the integration. The complexity shouldn’t be under-estimated.

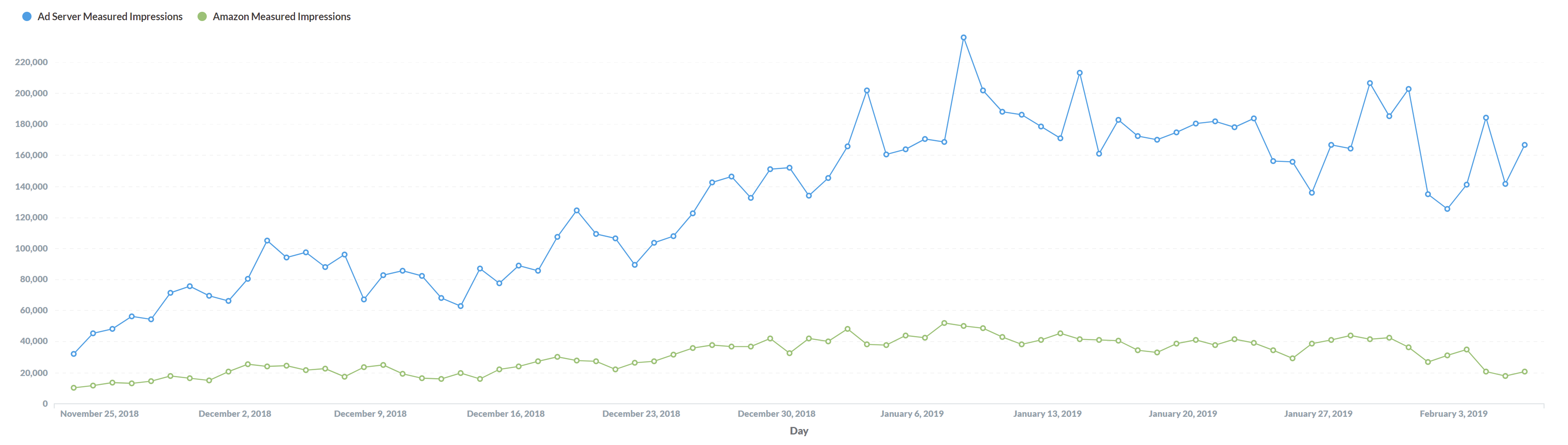

Not typical, but above is a screenshot of a serving discrepancy where the ad server is measuring more impressions purchased than the network. In cases where a discrepancy is determined to be “losing” impressions we recommending optimizing buys based on CPM determined by the ad server.

Other considerations:

Reporting: staggeringly Amazon, one of the most technology-forward companies in the world, is arguably the most challenging reporting partner of the 85 we support. They don’t yet offer a reporting API, which adds complexity, but on top of this challenge their revenue reporting is regularly delayed. Network reporting outages are inevitable in our industry but concerns become compounded when said network makes up 40% of your daily revenue.

Countries: Amazon still buys in selective countries, if you’re looking to augment a country where amazon doesn’t have a presence, it’s worth considering.

Revenue Swings: Amazon is very heavily focused on retail. Historically Black Friday is a very lucrative time to have Amazon Header Bidding, however the Q1 hangover is a harsh reality.

Management Overhead:

- You need how many line items? The recommended method for setting up includes hundreds– or thousands of line items. We manage all line items programmatically but many find this process tedious and confusing to manage.

- Flat Waterfalls put other buyers at a disadvantage. We’ve experimented and have determined the optimal way to manage header bidding line items is to include them in the traditional cascading priorities, rather than allowing free reign of dynamic bid-enabled access. Dynamic pricing is only beneficial if a substantial amount of your demand is enabled for dynamic competition. In other words, protection is necessary for your non-bidding partners.

So…is it worth it?

In short, yes.

- If you’re willing to undertake the technical challenge of implementation,

- brave the reporting challenges & outages,

- and navigate the management overhead of creating and managing the thousands of line items.

Amazon Header Bidding has proven themselves as a core partner for the customers who’ve succeeded with the implementation, so consider them as a buyer for your inventory if:

- You’re open to the technology challenges.

- You’re willing to tackle the management hassle — or have a method for automation!

What our customers say:

“Our reasons for using AdLibertas are simple – they allow us to make more money per ad served and ‘ignore’ daily waterfall management allowing us to focus on what we do best: build and launch fun games consistently & profitably.”

Andrew Stone, CEO, Random Logic Games

About us:

The name AdLibertas comes from our motto “ad victoriam mercaturae ducit libertas” which is Latin for “the free market wins.” As former app-developers we’ve designed a publishers-first solution to help app developers earn more from their in-app ads. Contact us or sign-up to learn how other app developers are earning more by automating their current advertising platforms with AdLibertas.