The Q1 Hangover

We all knew this was coming…

My day of reckoning is tomorrow.

Some say it’s an adjustment period– others call it a massacre– one thing’s clear: it’s very hard to watch inventory prices fall after the glorious year-end highs occurring only days ago. Knowing doesn’t make it easier.

Wow, that was brutal!

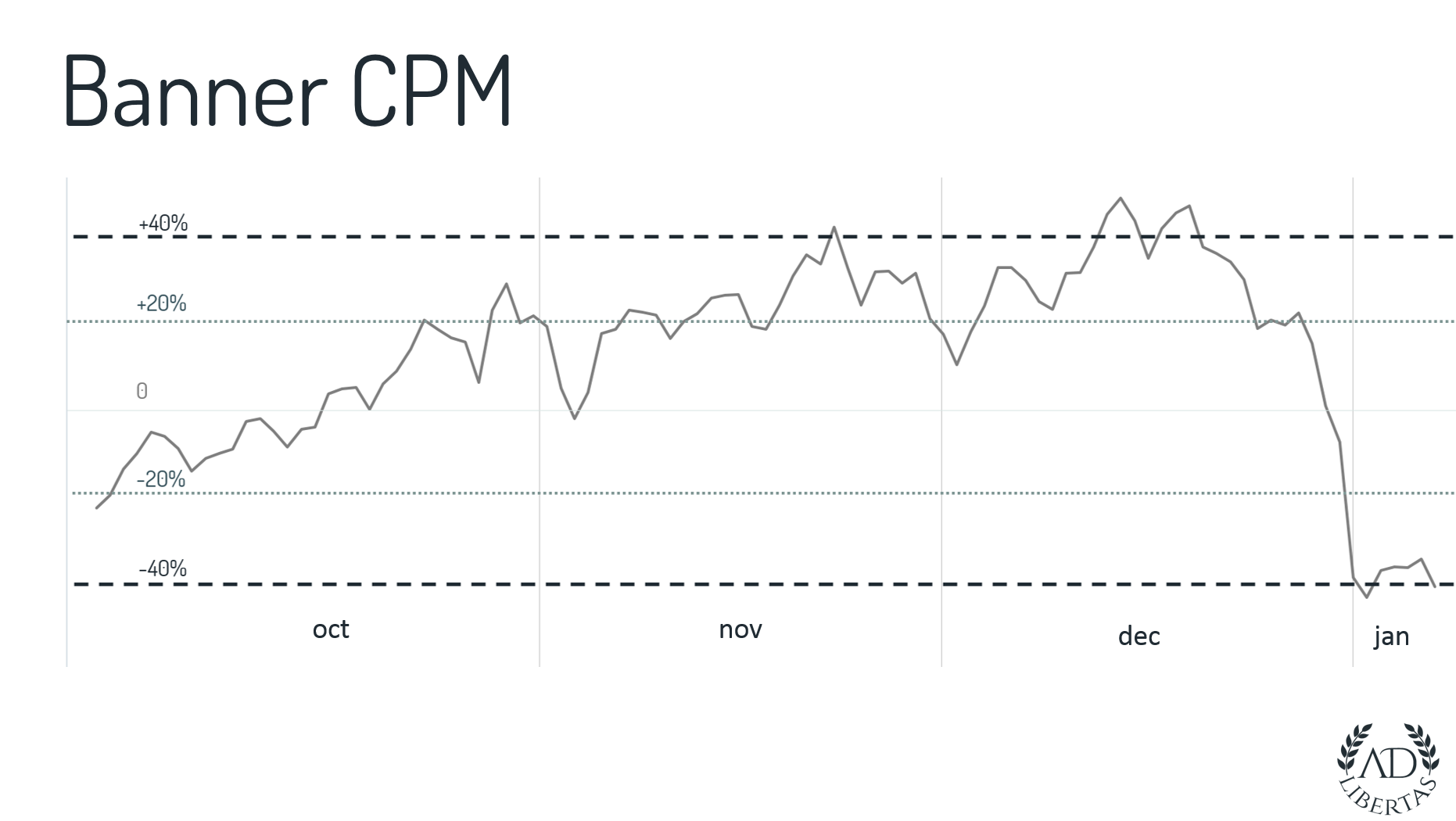

This year we saw massive drops in banner prices, this is shortly after seeing record-highs in Q4. Banners continue to demonstrate high market volatility – reacting much more drastically to outside influences, indicating a higher percentage of brand and retail-specific campaigns.

Are you seeing this with other apps?

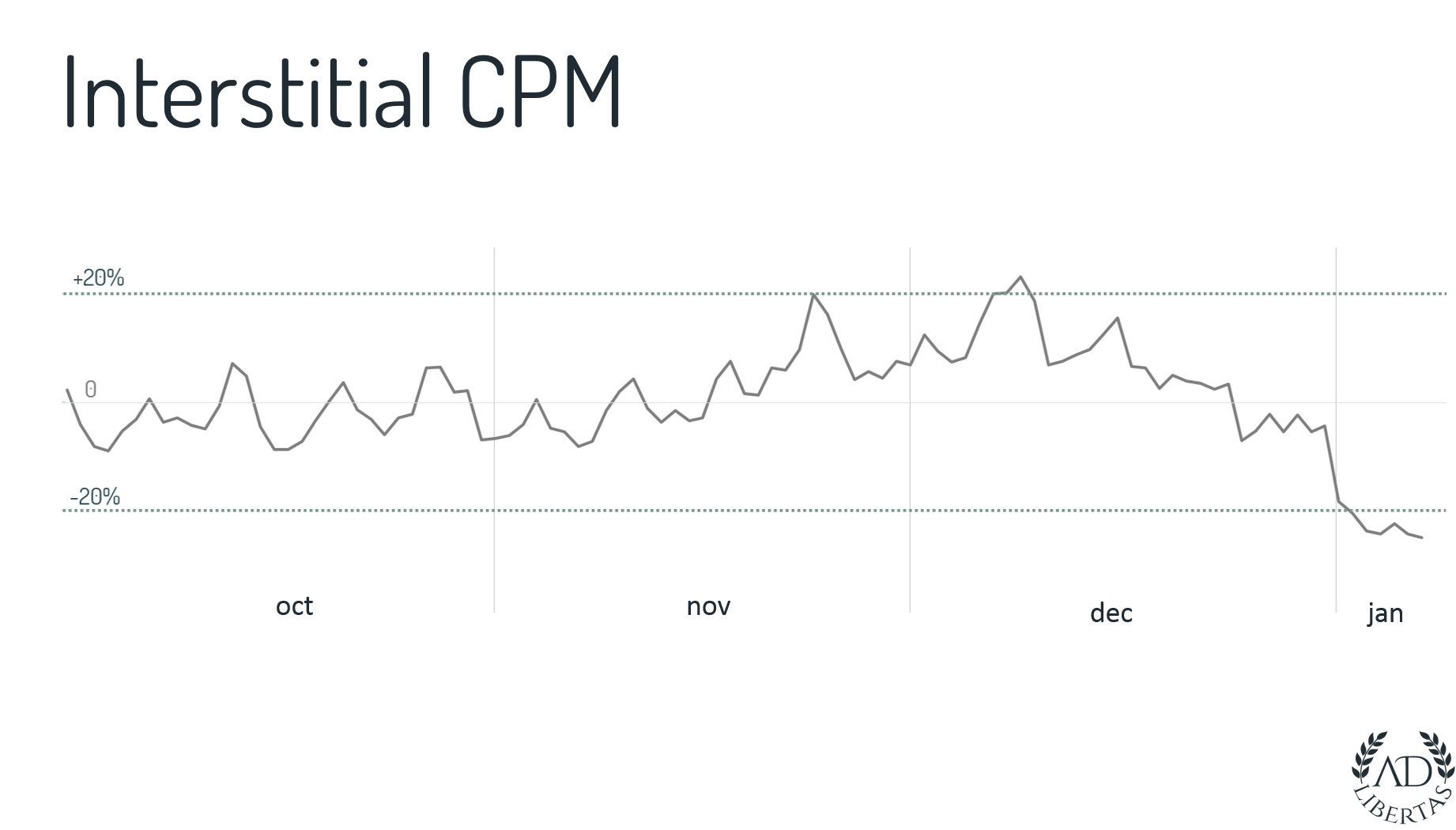

No one has was spared the impact of Q1. However, individual results did vary. By and large, interstitial revenue fared much better than banners – indicating full screen ads have a higher reliance on fixed budget performance campaigns. Indeed publishers with higher revenue percentages saw much less impact (-20%) vs banners (-40%).

Do you think it’ll go lower?

In short we’ve hit the trough. At least, it won’t go down for much longer. The industry remains bullish on mobile ad revenue for 2018 and while there is an ever-increasing amount of competition the market continues to share the spotlight and grow in importance.

Reasons why year-end revenue increases historically:

- Holiday shopping, both retail and online is capitalized by advertisers and a large influx of shopping campaigns vie for inventory.

- Yearly advertising budgets come to an end, agencies with under-spent inventory will start to price higher (at the expense of their margin) to reach budgetary and performance goals.

- The holiday brings new devices—as gifts—into the market, increasing the number of installs and impressions.

- Most mobile apps see a spike of usage during the holidays as people are outside of work, traveling and in general have more leisure time.

- Performance buyers increase budgets in November to beat the holiday app store ranking “freeze.” By timing the market correctly, they can buy themselves to a high place, and receive a week of “free” placement at that ranking with no extra spend.

Conversely, revenue decreases in Q1:

- Advertising budgets reset and require re-authorization, or re-justification to continue, if they do.

- Performance budgets will often pause and re-evaluate pricing as there remains a glut of inventory — more devices in market — but less demand dollars in competition for inventory.

These factors make it inevitable for the market to slump for the first few weeks of Q1 but like years past, we’ll see a rebound starting mid-January.

Now is a good time to re-evaluate your ad stack; prioritize, test or fix your existing ad-technology; find new partners; or cut new deals. In three short months we’ll be looking at seasonal highs once again.