Q3 Top Network Performance

Q3 Top Network Performance

Heading into Q4 many publishers look for additional demand partners to supplement performance for advertising’s most lucrative 10 weeks of the year.

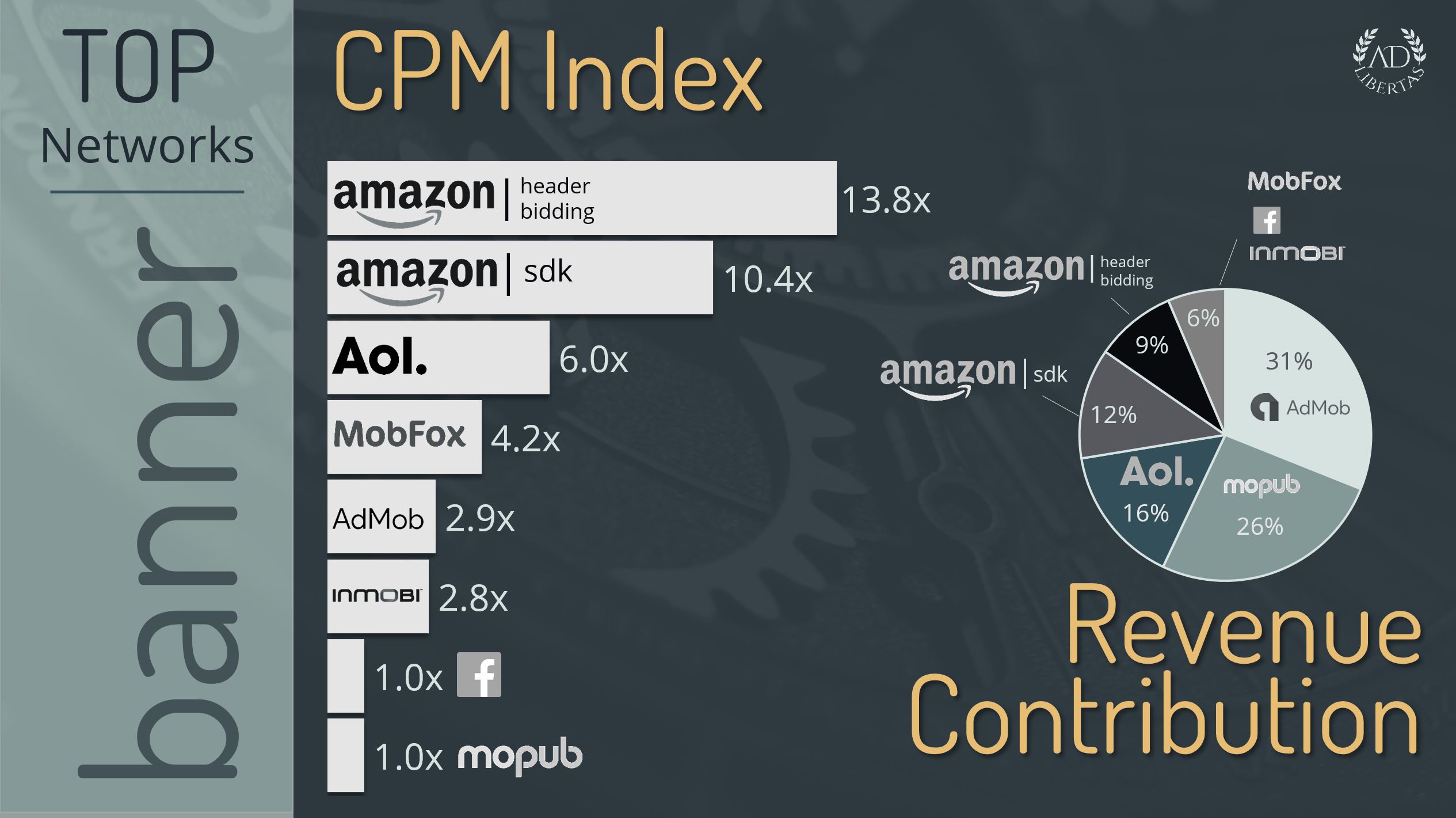

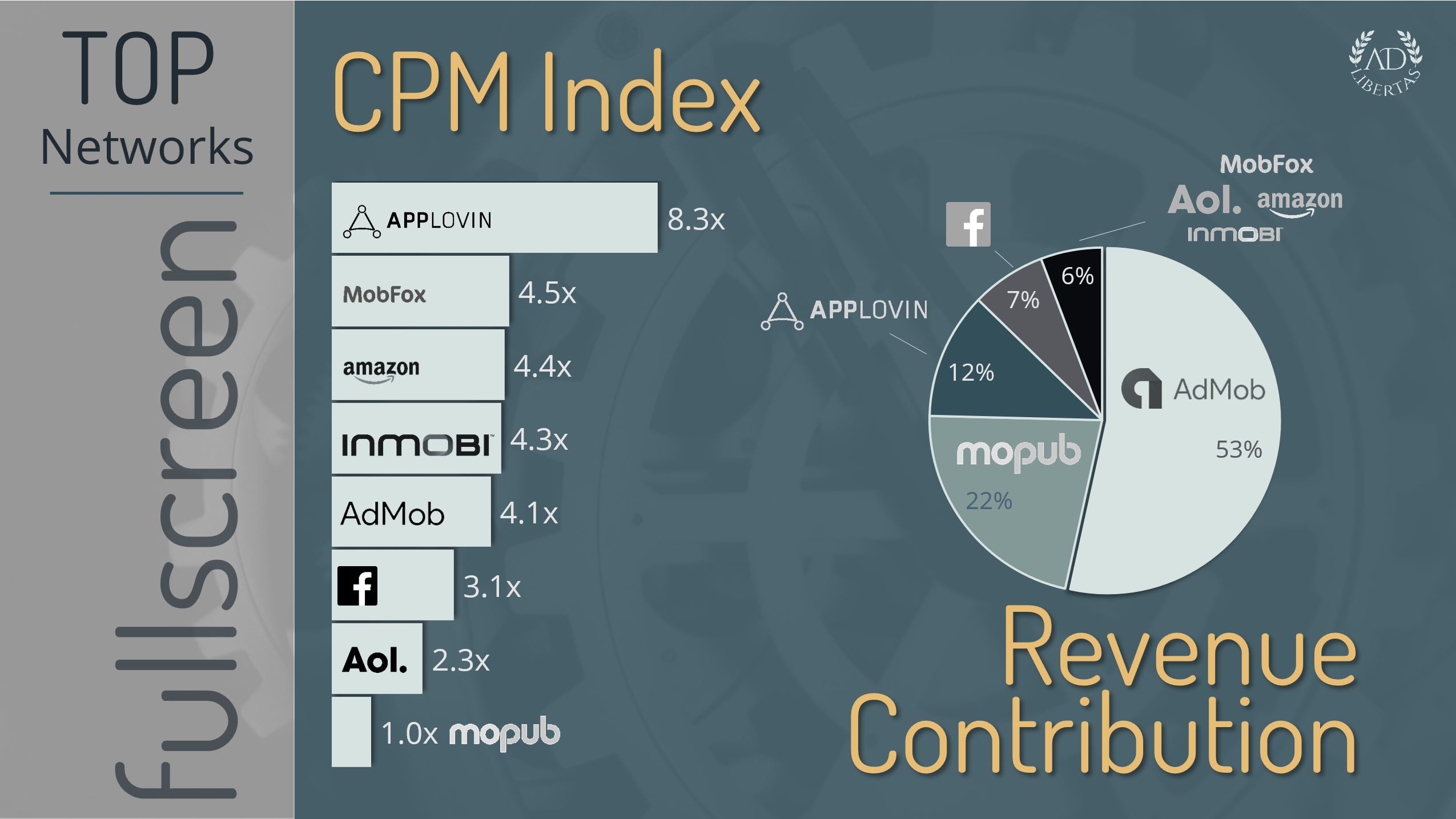

We’ve outlined recent top performing network performance from our customers over the last 30 days for banners and full screen ad units to help you identify networks missing from your ad stack:

- CPM Index – shows the multiple of the lowest performing network

- Revenue Contribution – outlines the total percentage of revenue a network compared against other top networks – which makes up ~90% of total earned revenue.

Analysis:

- Amazon – Amazon’s Header Bidding is paying dividends with a few of the customers who’ve managed to overcome the technology challenges when serving on banners. It should be noted although the CPM is over 10X MoPub’s index both Amazon header bidding and their SDK only buy in top-tier countries. That said, combined they still manage generate 28% total revenue and may be worth integration effort for those looking for performance on banners.

- AppLovin – positions itself as a high-performer for full screens. Focusing in tier-one countries give is an 8X+ increase over MoPub index CPM but their volume of buying still puts them at 12% of overall fullscreen buys.

- AOL – continues to impress with solid banner performance in top-tier countries and would be a worth consideration to anyone looking for additional support for Q4.

- MobFox – Supplying ~4% of overall revenue for banner & full screens makes impact minimal but the ease of the Mobfox s2s integration with MoPub could make them a worthy partner for someone looking for additional support.

- InMobi & Facebook generate low enough revenue & CPM to make tier impact nominal to our observations.